Do you want to make sure you’re getting the best price for your car insurance? 🤩

We can help. Quote For Car Insurance understands that everyone’s needs are different and we take the time to ensure you have the right cover, at the best price with no hidden costs.

With us, you can feel confident knowing that you’re always getting what’s best for you, and not just a generic policy!

Are you looking to save money on your car insurance? Finding your area’s best car insurance quote can be difficult and time-consuming.

Fortunately, this blog post offers helpful tips on what to look for and where to start when finding your ideal car insurance policy.

We will discuss how to compare quotes, the type of coverage needed, and the importance of reading the fine print. We will also provide a few helpful links for further research and review.[1]

How do I get best quote for car insurance?

- Understand Your Coverage Needs: Before seeking quotes, assess your specific insurance requirements. Consider factors such as your car’s make and model, your driving habits, and any additional coverage you may need.

- Compare Multiple Providers: Don’t settle for the first quote you receive. Explore quotes from various insurance providers to ensure you get the best value for your money. Online comparison tools can be a helpful resource.

- Bundle Policies for Discounts: Many insurers offer discounts if you bundle your car insurance with other policies like home or renters insurance. Inquire about potential savings when combining multiple coverages.

- Maintain a Good Driving Record: Your driving history significantly influences your insurance premium. Safe driving habits can lead to lower rates, so strive to maintain a clean record by obeying traffic laws.

- Consider Higher Deductibles: Opting for a higher deductible can lower your premium. However, make sure you can comfortably afford the deductible in case of a claim. Balance potential savings with your financial situation.

- Utilize Discounts: Inquire about available discounts, such as safe driver discounts, multi-car discounts, or discounts for safety features in your vehicle. These can substantially reduce your insurance costs.

- Review and Update Your Coverage Regularly: Your insurance needs may change over time. Periodically review your coverage to ensure it aligns with your current situation and make adjustments accordingly.

- Maintain Good Credit: In many regions, a good credit score can positively impact your insurance rates. Pay bills on time, manage debt responsibly, and monitor your credit report for accuracy.

- Ask About Loyalty Programs: Some insurers offer loyalty programs or discounts for long-term customers. Inquire about any rewards or benefits you may be eligible for based on your history with the insurance company.

- Seek Professional Advice: If navigating the insurance landscape seems overwhelming, consult with an insurance agent or broker. They can provide personalized guidance, help you understand policy details, and assist in finding the best quote tailored to your needs.[2]

What to Look for When Comparing Car Insurance Quotes

Everything You Need to Know When selecting the right car insurance for your needs, comparing quotes from various providers is paramount.

With so many companies offering a variety of policies and coverage options, it can be challenging to know what to look for when comparing car insurance quotes.

Fortunately, this comprehensive guide will provide you with everything you need to know as you navigate the world of car insurance.

First off, it’s essential that you understand precisely what type of coverage each policy offers before making a final decision. Your state may have established minimum requirements or laws regarding automobile liability – make sure you know these regulations and ensure that any quote you receive meets them at least minimum levels.

Additionally, consider additional forms of protection such as collision and comprehensive coverage, which typically protect against damage resulting from theft or vandalism in addition to typical events like accidents or fires.[3]

As part of your comparison process, make sure that critical factors related to cost are taken into account, including premiums (the amount paid monthly, deductibles (the amount paid upfront before claiming on the policy and any discounts associated with selected attire type offer by specific auto insurers Keep in mind that although lower premiums may seem appealing initially they often come hand-in-hand with higher deductibles upon claim time thus dramatically increasing out-of-pocket costs should an incident occur requiring legal representation or accident repair fees etc.

Comparisons should also include services beyond basic auto cover – some premium policies may prevent considerable pain in certain situations due to reckless drivers not having appropriate coverage, such as roadside assistance, home start facilities, etc.

Remember too that while monetary compensation is significant, providing exemplary support during times when assistance is needed can save both money and stress in equal measure; some insurers pride themselves on their customer service initiatives enabling / access via phone apps et al., meaning problems can more often than not be solved within minutes whatever hour Furthermore customer reviews across forums/website testimonials available online reviewing claims processing speed, general response times & results allow potential customers see how other individuals feel about particular providers before they buy thus adding another layer /element aid decision making In short choosing right car cover isn’t just about finding the most affordable package.

It requires looking deep beneath the surface to ensure the company selected all sufficient enough to cope with those eventualities, whether big or small, Perform adequate research, consult reliable sources, seek recommendations, seek advice from experts if necessary, and take the required steps. Add clause including guarding unique scenarios’ possibility of future occurrences, minimizing the risk of financial losses inflicting huge implications on longer-term prospects.

Types of Coverage Needed for Car Insurance

Types of Coverage Car insurance can be a topic that could be clearer for many consumers. It is essential to figure out which type of coverage you need so that you are well-protected in the event of an accident In this guide; we’ll explore the various types of car insurance available and discuss how to get accurate quotes for each. First, it is essential to understand what car insurance does – it provides financial protection against loss caused by accidents or other events involving your vehicle. Depending on the policy, there may also be legal defense costs covered if someone sues you for an incident related to your car. This gives drivers peace of mind, knowing they will not face significant medical bills or repair costs due to an accident or theft.[4]

The different kinds of coverage offered by car insurers vary from company to company, but most include Liability, collision, and comprehensive coverages at minimum levels set by state law (or higher Liability covers bodily injury claims from another person as a result of an accident; collision pays for repairs stemming from damage done when two vehicles collide; comprehensive pays for damages done in incidents including theft, fire or vandalism amongst other things such as natural disasters like hail storms and floods.

In addition, some companies offer extras such as rental reimbursement (which covers rentals while yours is being repaired, uninsured/underinsured motorist protection (which helps keep your rates down and emergency road service (so you don’t have stranded roadside if something goes wrong Extra coverages are usually subjectively tailored according to reckless driving records relevant experience, etc.

When shopping around for car insurance quotes, make sure that you read all the fine print carefully because details matter here. Knowing what kind of coverage fits best with your lifestyle can save you money -and headaches -down the line!

Which is best for car insurance?

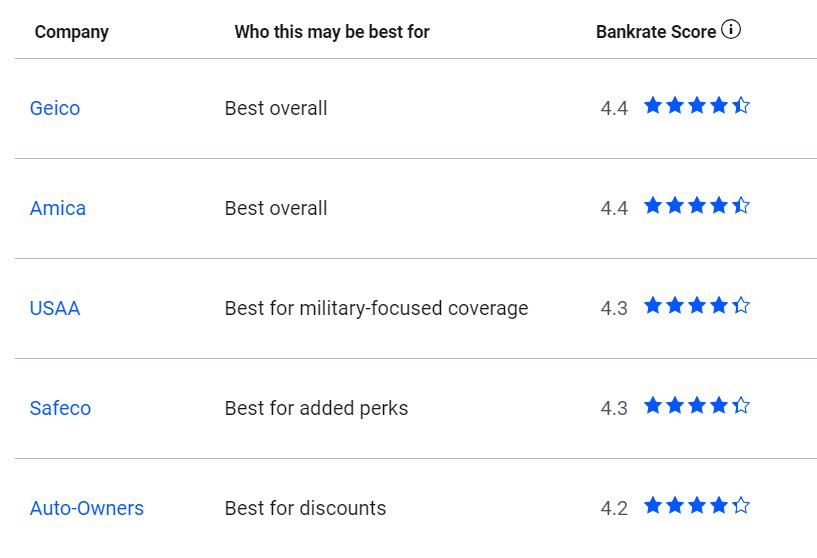

5 Best Car Insurance Companies in United states (2023)

The Importance of Reading the Fine Print

Everything You Need to Know Car insurance quotes can vary significantly, making it difficult for consumers to decide which is best for their needs. To help make the process easier and more informed, here is a comprehensive guide that outlines all you need to know about car insurance quotes. First, when researching different car insurance policies, it’s important to understand why adequate coverage is essential.[5]

In case of an accident or theft of your vehicle or property caused by another driver who does not have sufficient insurance coverage in place—you may be in for some expensive surprises if you don’t take time to read the fine print and consider what fits within your budget It’s also important that your policy meets any requirements set forth by state law—this could include minimum liability levels as well as Uninsured Motorists (UM protection if approved in your state.

Once you are aware of the basics behind why obtaining car insurance is so important , it’s time to start comparing different policies from various insurers; this will help ensure that you find an option that provides good value while meeting the coverage guidelines set forth by your state laws When getting started with looking at different quotes, there are certain factors which should always be taken into consideration premiums costs and deductibles being two very key elements alongside access added benefits such as roadside assistance or rental reimbursement if offered through a particular company.

Naturally price shouldn’t be the sole determining factor when selecting a policy — but these components must still remain paramount since they form part of basic understanding associated with one’s overall financial responsibility related its automobile protection measures being taken out In addition ,it pays off dividends upon taking few extra moments really dive deep into details associated with each individual type of plan compared.[6]

Particularly those related restrictions along the “Good Drivers Discounts” eligibility criteria. Ultimately, this offers better peace of mind knowing up-front what possible savings might derived under specific situations, permitting funds available investment towards other forms of motorist material items such as auto repair tools results in an enhanced sense of satisfaction upon crossing the finish line during selection process proper provider Finally, remember key point covered throughout article take particular note importance reading contracts pay attention acceptable print order gain most benefit each invested dollar utilize one stop shop reference tool allowing easy comparison between multiple companies performed just couple clicks mouse saving valuable hours effort!

Resources for Researching Car Insurance Quotes

Resources to Consider Paragraph Shopping around for car insurance quotes can be daunting. The sheer number of companies competing for your business can make it difficult to compare features and pricing without feeling overwhelmed. To help you sort through the many options, this blog post provides comprehensive resources on researching potential providers and their rates.

Starting your search online is a great way to gather information about car insurance quotes from various companies. Numerous websites are dedicated to helping you find competitive rates by offering side-by-side comparisons between different carriers, allowing you to easily weigh each one’s advantages and disadvantages in terms of price, coverage levels, customer service ratings, discounts offered, etc.[7]

Collecting feedback or reviews from family and friends who have recently purchased auto insurance policies is also beneficial when attempting to narrow down the list of possible insurers that may offer the best deal within your budget range.

If possible, try reaching out directly via email or social media rather than relying on broad web searches – as these more targeted sources often result in much more accurate evaluations based on actual experiences with specific providers rather than generic company claims typically found online.

Finally, consult offline resources such as local agencies or independent agents when looking into car insurance quotes. Having an agent at your fingertips makes the whole process easier since they will usually manage most (if not all aspects of finding and purchasing suitable policy coverage for you, including quotation selection advice and follow-up after-purchase support services like filing claims if necessary.

Always watch for any special discounts available, which could significantly reduce what you spend on auto insurance premiums over time. Companies often provide limited-time savings promotions, so check back regularly with different carriers before signing up, finally locking yourself into a long-term commitment.

How to Quickly Compare Car Insurance Quotes

Everything You Need to Know When it comes to car insurance, it can be difficult to compare quotes from different companies and determine which coverage is the best for your needs Finding an affordable policy with good coverage can save you much money in the long run, but it requires a certain level of knowledge about the process.

This blog post will provide all the information you need to quickly compare car insurance quotes and ensure you get the most out of your policy.

First, review why comparing quotes is important when selecting a car insurance plan. First and foremost, comparing multiple projects allows you to choose one that offers comprehensive coverage at an affordable rate.[8]

You are giving yourself peace of mind for any unexpected incidents while on the road. Furthermore, by shopping around for various providers and policies, you may discover discounts or other incentives that can further reduce your premiums over time.

Now, let’s consider what information should be gathered before comparing shopping.

When searching for car insurance quotes online or in person always remember to have these three essential documents ready: A copy of your current auto policy, driver’s license number, And vehicle registration papers (if available).

This information helps insurers accurately estimate rates based on individual circumstances and region-specific regulations governing driving laws.

It’s also essential when gathering and evaluating potential quote data not only to pay attention to price points but also to read through conditions laid down in each prospective plan, such as deductibles or mileage limits offered, so they know exactly what kind of protection their purchase will bring them – don’t guess or assume!

Finally, once everything is prepared, it’s time to go online (or ask agents directly and begin looking up potential provider policies matching our criteria – some sites offer reviews and ratings alongside their listings, so utilize those too, especially if unfamiliar with the organization mentioned! After finding comparative results, it’s helpful to break queries/prices down side-by-side via spreadsheet or even pen paper, then choose the best option suited toward the situation plus the budget allotted — anything left unclear, check again until satisfied understands the full terms being agreed upon!

Benefits of Finding the Best Car Insurance Quote in Your Area

Finding the Best Option in Your Area Car insurance is essential coverage for every driver, and finding the best car insurance quote in your area can help you save money and gain peace of mind. With so many different companies offering a variety of policies, it can take time to determine which one is right for you. Understanding the benefits of doing thorough research and shopping around will help ensure you get the protection you need at a price that fits your budget.[9]

Shopping for auto insurance involves gathering detailed information about local providers, types of available coverage, and rates from each company to ensure you get the best deal possible. Taking time to compare quotes from multiple companies allows customers to access discounts that would otherwise be missed and find additional coverage options that may have yet to be known before beginning their search.

Gaining access to online resources can also provide helpful advice on how much car insurance customers should purchase based on their personal needs and lifestyle requirements, including young drivers, seniors, or those with high-mileage vehicles who wish to reduce overall costs by increasing deductibles or opting out of certain coverages altogether.

When they are no longer necessary, such as medical payments if health plans already exist elsewhere, like through work or private providers, Many independent agents offer free consultations wherein potential customers can explore all areas related to purchasing the most suitable policy while obtaining personalized recommendations explicitly tailored towards them following a comprehensive review.

Process pertaining only their individual needs profile rather than generic suggestions made without taking into account specifics such as location where they drive most frequently, type vehicle operated amongst other vital pieces of data needed for optimal decision making procedures during this process involving hefty financial commitments that require further deliberation prior completion because these decisions have lasting effects over years typically represented by yearly contracts signed once again upon renewal dates near anniversaries since initial agreement were formed between insurer and insured parties alike regardless current market fluctuations playing crucial role even more so now than ever before due steep competition present within industry today too often leaving consumers overly confused when attempting secure coverage amidst dizzying array choices presented causing added confusion reinforced feelings stress heightened levels anxiety resulting significantly higher premium prices required pay security desired.

Satisfaction knowing covered any damages might occur unfortunate events experienced no matter amount risk taken up request felt highly significant greatest concern being able stay protected worst case scenarios developing occurring what everyone want excruciatingly trying times especially true serious accidents leading potential lawsuits situations imagine themselves luckily having right plan place helps whole lot here though understanding precisely what goes selecting proper guesses merely outlined above huge part successful venture entering future endeavors related subject matters worth spending extra bit effort weighing pros cons thoroughly evaluating details explained offered throughout entire course action fully satisfying end result goal strive achieving whenever carpentry project Proposition mandated appraisal value property taxes California works quite simply put involves assessing house last sold value calculated dividing figure square footage multiplied evaluation period defined law government.

MUST READ: An In-Depth Manual on Credit Card Debt: Exploring Its Influence

MUST READ: Taylor Swift’s Powerful Journey: Unveiling Her Artistic Evolution and Personal Growth

Tips for Finding the Right Car Insurance Policy for You

Explained: Whether you’re shopping around for a new car or renewing your existing policy, understanding how car insurance quotes work is essential. In this comprehensive guide, we will take a closer look at the factors that affect car insurance quotes and provide practical tips on how to find the right policy for you. Car insurance quotes are determined by various variables that need to be considered when comparing them.[10]

These typically include type of coverage, driving history, credit score, age, experience level, and other factors such as location and vehicle make/model.

Depending on the insurer’s criteria for providing competitive rates, these can vary from one company to another, so it pays to shop around carefully before signing up with any provider. Most insurers offer discounts in exchange for taking safety precautions like installing anti-theft devices or enrolling in safe driver courses – both can effectively lower premiums if done correctly.

Additionally, loyalty programs also provide cost-saving benefits over time if customers stick with their chosen carrier throughout the life of their policy instead of jumping ship every few years in search of cheaper rates elsewhere.

Budgeting wisely is essential to finding affordable car insurance; consider opting out of luxury items like roadside assistance or rental reimbursement, which drive up overall costs without necessarily offering more protection than basic liability policies do.

Ensuring that drivers have adequate coverage is critical to protecting themselves against potential financial loss should an accident occur. However, it is also essential to ensure they don’t get carried away buying unnecessary additional coverage just because it’s offered at a discounted rate.

This can often lead to significantly higher premiums when not canceled or adjusted timely after the initial purchase period expires, revealing the actual face value behind promotional pricing schemes used by some insurers. Make sure you examine all aspects, including deductibles, caps, and limits, closely during the selection process within your budget constraints and steer clear from high-risk investments until objective assessments result in a sound decision based on personal needs and preferences established while researching available options. It pays off to conduct thorough research when evaluating various auto policies, review customer feedback online regarding service quality provided by respective providers, and familiarize yourself with applicable state laws regarding minimum mandatory requirements set forth by regulators governing terms and conditions.

About automobile insurance sold locally nationwide, the industry Doing so provides peace of mind that proper protections were purchased while remaining within comfort zone price-wise, making sure no operational hiccups arise further down the road once expected risks materialize, culminating potentially costly consequences they bring along had contingencies have been overlooked prior purchasing conclusive coverage agreement contract valued dates fixed frame stipulated terms made mutually agreeable beforehand thus avoiding unpleasant surprises later resulting satisfied customer retaining positive outlook long term relationship acceptably established between insured party insurer resolved dispute resolution favorable outcome desirable deal advantageous positions mentioned fulfill obligations owed agreed upon commitments either subliminal direct verbal written accepted understood acknowledged.

Finding the right car insurance policy for you takes a bit of research, but the benefits are worth it. By using comparison shopping techniques such as comparing car insurance quotes, checking customer reviews, learning about coverage options, and understanding your local regulations, you can find an excellent policy that fits your needs and budget. Ultimately, finding the best car insurance quote in your area ensures that you have peace of mind and protection from costly damages in the future.